The Moroccan government has lately found an opportunity to make advances over their neighbour in an enduring arms race that goes back to the 1970’s.

Morocco’s border disagreements with Algeria were due to non-recognition of Algeria’s colonial borders by the Moroccan regime. Both countries’ armed forces have engaged in costly equipment upgrades in recent years, viewing each other as the principal threat to each other’s sovereignty, and equally reluctant to let the other nation gain the upper hand militarily.

While Algeria wrestles to overcome a battle with inflation as well as a deteriorating trade partnership with Russia, a state entrenched in a war of attrition against Ukraine, Morocco seeks to take the advantage. While it is difficult to tell how far they will succeed in this endeavour, it is certainly the case that Algeria’s economic and sourcing difficulties present Morocco with room for growth to outpace them.

Morocco’s defence budget

The leading data and analytics firm GlobalData has released its report on Morocco Defence Market 2023-2028 (April 2023). The report expects to see the Moroccan government’s defence budget rebound from a decline in 2021-22, when the country registered a -12.1% compound annual growth rate (CAGR) in their defence expenditure.

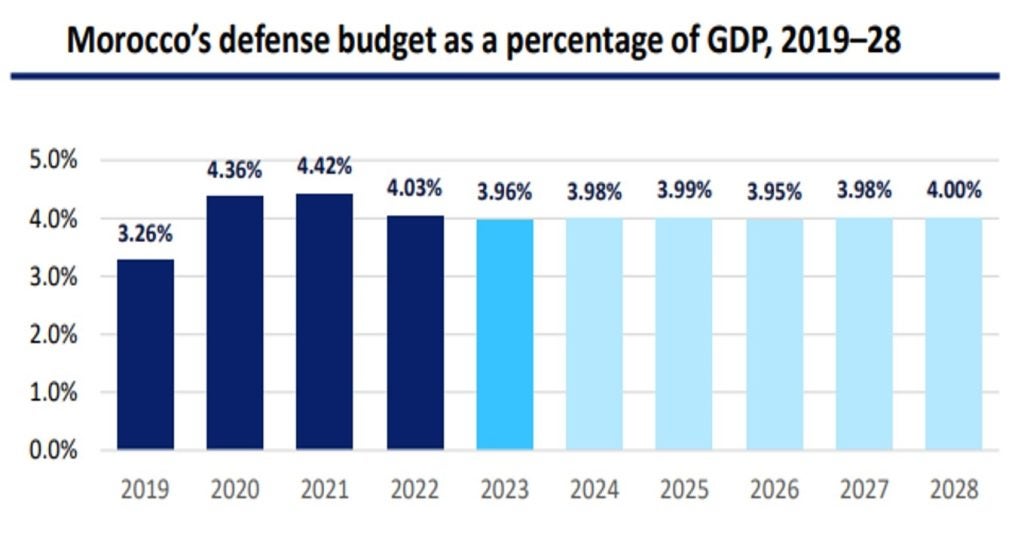

Morocco spends a significant amount of its overall gross domestic product (GDP) on defence. In 2019, this was 3.26%, but has grown to 3.96% (2023), constituting a positive CAGR of 5.0% during the period. This share of overall GDP is expected to fluctuate slightly over the forecast period, before reaching 4.00% in 2028.

Comparatively, this figure is exceptionally high, but Morocco’s primary rival Algeria spends a similar proportion of its GDP on defence. The heightened tensions between these two countries explains this unique situation, and the nature of the Saharan operating environment—flat, wide-open plains with little natural cover—necessitates large resources going towards highly mechanised and protected forces.

The rate of growth per capita is predicted to rise in the forecast period, from $64 in 2023 to $185 by 2028, at a slower but still positive CAGR of 2.3%.

It is important to note these increases in defence expenditure come at a time where the Moroccan economy has grown slowly too, with its real GDP registering a CAGR of only 1.1% during 2019–23, and projected to increase somewhat to 3.1% over 2024–28.

The authoritarian nature of Morocco’s political system explains this to some degree, as the government has a largely unchecked ability to direct state resources to consolidate its own power, but it also speaks to the dominance of the growing feud with Algeria.

Outpacing Algeria

Morocco prioritises spending on a sizeable and capable force, often setting procurement priorities against Algeria’s respective capabilities. For instance, Morocco’s alarm at a contract signed by Algeria for 14 of Russia’s advanced Su-57 stealth aircraft prompted ongoing inquiries into acquiring F-35s from the US.

Morocco’s purchase of the Israeli Skylock Dome and US Patriot missile defence systems can be seen as direct counters to Algeria’s purchase of the Russian S-400 missile systems, and its interest in eventually acquiring the S-500.

Defence industrial base

Morocco is seeking to strengthen and grow its defence industrial base. Therefore, developments associated with this growth, such as an increase in jobs and patents filed, will constitute the key market trends in Morocco.

Since 2019, the number of jobs in the defence industry in Morocco has been increasing. GlobalData intelligence shows that the number of jobs being posted in Morocco has increased. In 2019, an average of 24 jobs were being posted per month, rising to an average of 36 jobs per month in 2022.

These figures reflect the strengthening of indigenous defence production in Morocco, as the state seeks to attract foreign direct investment, promote domestic innovation, and more broadly grow the defence industrial base.