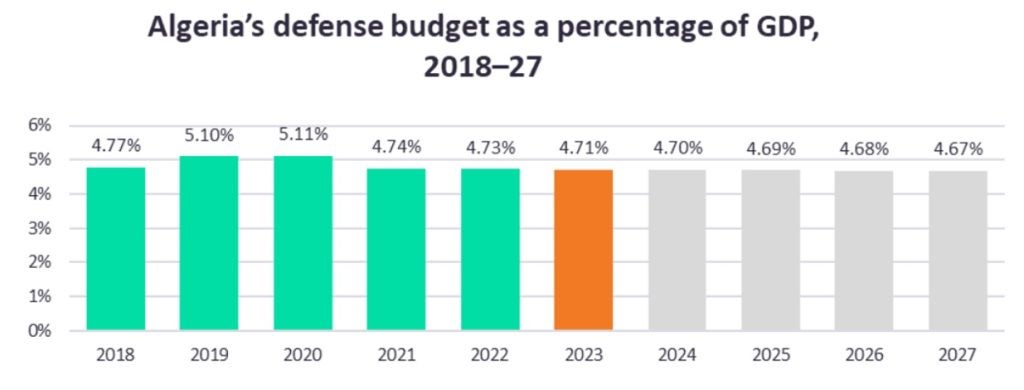

Algeria is the largest military spender in the African region, with a defence budget of $16.7bn in 2023 according to GlobalData’s Algeria Defence Market, 2023-2028 report. This appears highly promising at first glance, however GlobalData’s report identifies a concerning gradual change that undermines Algerian defence ambitions.

The Algerian Government face the difficult problem of sustaining its robust defence expenditure while the country’s flat growth rate stifles its procurement activity. Algeria’s commitment to bolstering its military capacity to deter Morocco in a hitherto unending arms race over border claims will see the country struggle to keep up in the near future.

Algeria is an oil-based economy, and with oil prices recovering due to controlled supply by the organisation of the petroleum exporting countries, the country is likely to show moderate recovery. However, ongoing fiscal weaknesses in the Algerian economy will undermine this expected recovery as it translates to flat growth in defence expenditure going forward.

As the North African country aspires to achieve military supremacy in the region, they will surely lose the edge against Morocco as its economic condition threatens to undermine defence efforts.

In 2023, Algeria is expected to spend $2.9bn on the acquisition of equipment, out of the total defence budget of $16.7bn, accounting for a compound annual growth rate (CAGR) of 5% during 2019–23. Over 2024–28, Algeria’s defence acquisition budget is expected to grow at a relatively flat CAGR of 2%. The cumulative acquisition budget is forecast to amount to $15.9bn over 2024–28, an increase compared to $10.5bn during 2019–23.

Arms race with Morocco

Algeria’s border disagreements with Morocco were due to the non-recognition of Algeria’s colonial borders by the Moroccan regime. Both countries’ armed forces have engaged in costly equipment upgrades in recent years, viewing each other as the principal threat to their sovereignty, and equally reluctant to let the other nation gain the upper hand militarily.

Until now, Algeria was ahead of its neighbour for some time. But now the problem is that there is a real possibility that Algeria’s spending will gradually slow down, leaving it on the backfoot in this arms race.

In this race, Morocco is backed by the US and is a major buyer of its equipment and arms, whereas Algeria has been making most of its defence procurements from Russia, and to a lesser extent China, Germany, Italy and the US. Hence, the two nations are wary of each other.

Russian depletion

Russia is the single largest defence supplier to Algeria and maintains a close strategic partnership with the country. In fact, Algeria alone buys around half of the Russian arms exported to the African continent. Hence, it is a valuable consumer for the Russian defence industry.

However, as Russia is engaged in a taxing war of attrition against Ukraine, Russian forces themselves are pushed to their limits as they begin to feel the prospect of equipment depletion.

On top of the flat growth in the economy, Algeria must also face the prospect that its long-time strategic partner and defence equipment supplier will fail to live up to its traditional trade partnership.

This relationship has already begun to sour even before Russia’s invasion of Ukraine. On 27 December 2019, Algeria reportedly signed a deal for 14 Su-57 fighters as a part of large military deal that also includes the purchase of 14 Su-34 and 14 Su-35 aircraft. However, as of January 2022, reports indicate Algeria has rejected delivery of the Su-35 fighters due to their sub-par avionics, and as such the requirement for multirole aircraft remains unfulfilled.

Sourcing from other countries will prove even more difficult for Algeria as the US recognised Moroccan sovereignty over Western Sahara, following the agreement to establish relations between Morocco and Israel in December 2020. This US decision provoked anger in Algeria, which, according to a statement by the Algerian Foreign Affairs Ministry in January 2021, asked Washington to be “impartial when dealing with regional and international crises”.

Therefore, Algeria is likely to expand its security presence in the region to persuade the new US administration of the need to hear Algeria’s point of view and reaffirm the country’s central role. So, with mounting military pressure in the region growing, Algeria must offset the loss of Russian equipment if they are to sustain their ambitions in a political climate that is starting to turn against them.