The Republic of Korea (ROK) heavily relies on China for growth (30% exports), yet even more so on America for national security (300,000 troops permanently stationed on the peninsula) according to the macroeconomic research firm TS Lombard, a company in the GlobalData group.

This raises questions about South Korea’s foreign policy as the country balances the offerings of the two superpowers, which are intended to coax the country into their distinct spheres.

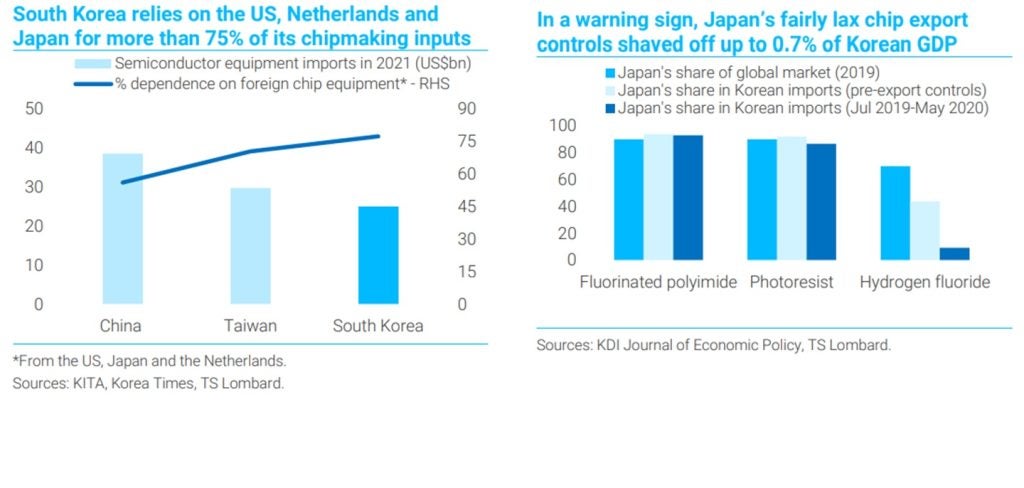

As the Biden administration stopped Chinese imports of semiconductors this time last year, and as China starts to consume its two-year stockpiles, preventing the ROK from supporting the “chip 4 alliance” alongside the US, the Netherlands, and Japan would be very important to sustaining its microchip imports.

To clarify the severity of the South Korean economy, in its Macroeconomic Outlook Report on South Korea, GlobalData states that China alone brings in $138.6bn in imports and $162.9bn in exports. The ROK’s next biggest trade partner is the US, which trails behind with $73.6bn in imports and $96.3bn in exports. This margin gives us some understanding behind the stark reality the ROK faces.

In a 2022 editorial, China’s state-owned Global Times likened joining the chip 4 alliance as something equivalent to the ROK committing “commercial suicide”.

But even in the face of the Chinese threat, the fundamental question is not which side will the ROK turn, but when will they inevitably side with the US?

ROK chipmaking

The South Korean Government ultimately has little choice but to bow to US wishes in this matter.

In the wake of the Japan/Netherlands announcement to place export controls on three components of microchips, the ROK will be forced to act to avoid its own isolation from the chip market.

TS Lombard states that the key reason is that South Korean chipmakers themselves have high import dependency in terms of critical chipmaking equipment – more than three-quarters of these inputs come from the US, the Netherlands, and Japan.

Meanwhile, its localisation rate for chip manufacturing equipment is only 20%, making South Korean chipmakers equally vulnerable to being cut off themselves, if Seoul were inclined to help China evade the US Government’s stringent chip controls.

Replacing Chinese support

To offset the loss of future Chinese trade, it could be said that ROK industries themselves are formidable revenue drivers.

For example, in the defence industry, ROK defence firm Hanwha has given the European main battle tank (MBT) market for German Leopard 2A7s a run for their money. A deal with Poland for the company’s K2 Black Panthers, 4A-50 fighter jets, and howitzers accrued $4.75bn.

Breaking into the European defence industry will prove to yield good results as European countries are yearning for cheaper platforms than the Leopard, that are also on relative parity in their capabilities.

American investment also goes some way to shoring up ROK industrial activity as the GlobalData Intelligence Centre shows data indicating that companies receive venture financing and private equity from US companies. Hanwha received these investments from companies like Lockheed Martin.

Leading ROK conglomerate Chaebol dominate key parts of next-generation industry, such as 5G infrastructure, Electric Vehicles (EV) and EV batteries and, of course, semiconductors.

Another growing segment is defence, with President Yoon saying last year he aims to make the ROK one of the world’s top four defence exporters.

Still, Chinese EV/battery firms will soon give South Korean and other legacy automakers a run for their money, with Chinese firms keen to ramp up EV exports over the next two years, with Europe as a top focus.

The direction of travel towards economic decoupling between China and the US is inexorable. The sooner South Korea make more sustainable efforts to face the inevitable, the better the position the country will be in as the technology war against China ramps up in the years ahead.