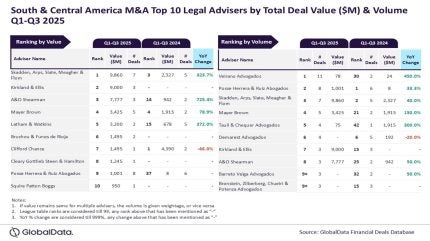

In the realm of mergers and acquisitions (M&A), Skadden, Arps, Slate, Meagher & Flom, and Veirano Advogados have emerged as the top legal advisers in the South & Central American region for the first three quarters (Q1-Q3)of 2025, according to GlobalData, a data and analytics firm.

As per GlobalData’s Financial Deals Database analysis, Skadden, Arps, Slate, Meagher & Flom secured the foremost position based on deal value, having advised on transactions totalling $9.9bn.

On the other hand, Veirano Advogados claimed the top spot in deal volume, participating in 11 deals.

GlobalData lead analyst Aurojyoti Bose said: “Veirano Advogados was the only legal adviser to hit double-digit deal volume during Q1-Q3 2025. As a result, the Brazil-based firm registered a massive jump in its ranking by volume from the 30th position during Q1-Q3 2024 to the top spot during Q1-Q3 2025.

“Meanwhile, the total value of deals advised by Skadden, Arps, Slate, Meagher & Flom registered more than 4x year-on-year jump and subsequently its ranking by this metric improved from the third position to the top position. Three of the seven deals advised by Skadden, Arps, Slate, Meagher & Flom during Q1-Q3 2025 were billion-dollar deals. The involvement in these big-ticket deals helped it lead the table by value.”

Close on the heels of the leader in deal value was Kirkland & Ellis, with its advisory role in deals amounting to $9bn. It was followed by A&O Shearman with $7.8bn, Mayer Brown with $3.4bn, and Latham & Watkins with $3.2bn.

In terms of volume, Posse Herrera & Ruiz Abogados took the second place with involvement in eight deals. Skadden, Arps, Slate, Meagher & Flom featured in this category with seven deals. Mayer Brown and Tauil & Chequer Advogados rounded out the list with five and four deals, respectively.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.