Germany’s rising weapons manufacturer, Diehl Defence, has signed a memorandum of understanding (MoU) with LIG Nex1, a major Korean defence contractor for missile systems, during the ADEX exhibition in Seoul last week.

Since Diehl’s Iris-T short-range air-to-air missile was selected for the Republic of Korea’s indigenously developed KF-21 Boramae fighter aircraft in April 2023, Diehl Defence has been gradually building up co-operation projects with Korean industry partners.

According to intelligence from GlobalData, a leading data and analytics company, the aerospace sector dominates the South Korean defence industry.

Last year, the country accounted for seven aerospace-related deals while the next largest sectors – unmanned autonomous systems and simulation and training – each accounted for one. To date this year, there have only been two aerospace deals.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWhile Iris-T missiles feature on the republic’s indigenous fighter aircraft, this is expected to pave the way for other missile applications.

See Also:

A way to supply South Korea’s missile defence needs?

With its expertise as an experienced missile company, LIG Nex1 will begin to help integrate the Iris-T system into the Asian market.

According to GlobalData’s Missile Defence Systems (MDS) market analysis for the next decade, LIG Group – of which LIG Nex1 is a subsidiary – will account for the fourth-highest share (6.2%) in the Asia-Pacific MDS market.

The parent company is expected to garner business worth $11.9bn (16trn won) over the forecast period owing to its contracts for the Cheolmae 2, Cheolmae 4-H, S-SAM Block-III and L-SAM-II missile defence systems for the Republic of Korea Armed Forces.

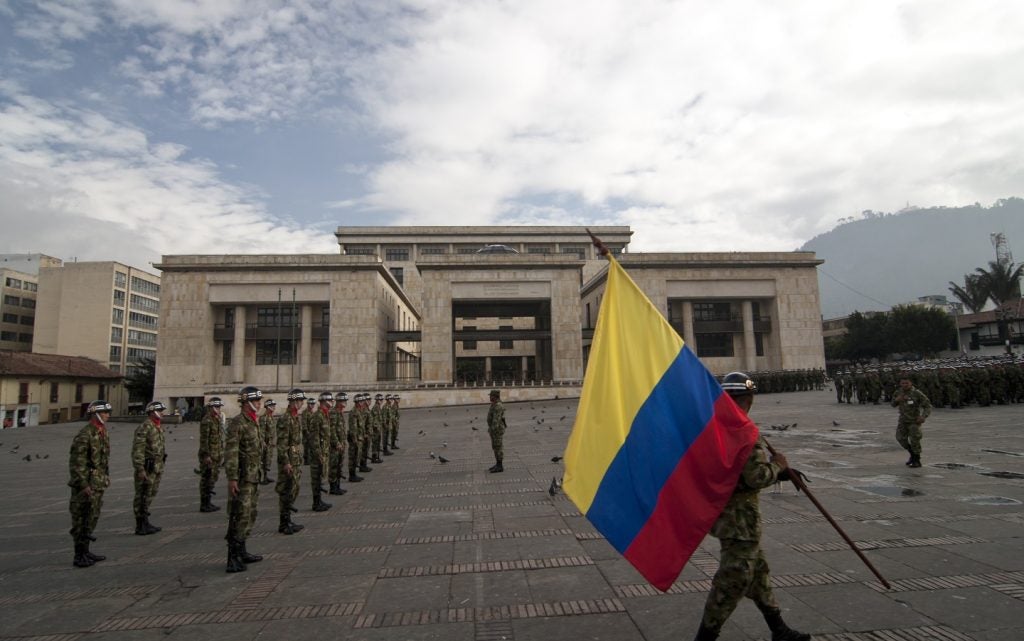

The Republic of Korea is a particularly attractive market for missile defence systems as GlobalData tells us the nation must maintain a state of readiness in response to missile threats from its aggressive peninsular neighbour, North Korea.

As such, although North Korea also has access to much longer-range ballistic missiles, it is unlikely to use them against South Korea as shorter-range missile systems satisfy its strategic objectives.

With growing demands in the Asian market for missile systems, Korean industry partners are becoming more and more involved in the programme and will gain benefits from these demands.

The Iris-T is combat-proven in Europe

The medium-range, ground-based Iris-T variant has already gained combat exposure in the high-intensity conflict in Ukraine.

At the end of April 2023, the German Bundeswehr gave the system to Ukraine; the second of four systems to be donated to the country amid a costly war of attrition. Likewise, Estonia and Latvia have entered negotiations with Diehl Defence to jointly procure the system.

The Iris-T medium-range launcher unit is based on a MAN 8×8 truck with eight missile container launchers mounted at the rear. The missile container launchers are arranged so that they include two banks of four missiles.

Our signals coverage is powered by GlobalData’s Disruptor data, which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors. These signals help us to uncover key innovation areas in the sector and the themes that drive them. They tell us about the topics on the minds of business leaders and investors, and indicate where leading companies are focusing their investment, deal-making and R&D efforts.