Boeing and Northrop Grumman are among the companies best positioned to take advantage of future drones disruption in the aerospace and defence industry, our analysis shows.

The assessment comes from GlobalData’s Thematic Research ecosystem, which ranks companies on a scale of one to five based on their likelihood to tackle challenges like drones and emerge as long-term winners of the aerospace and defence sector.

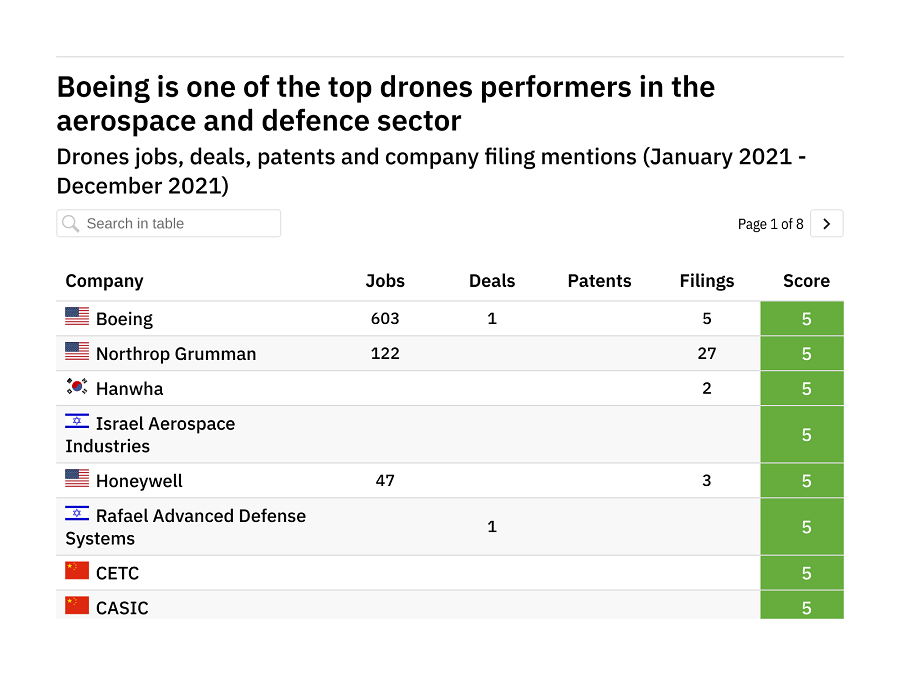

According to our analysis, Boeing, Northrop Grumman, Hanwha, Israel Aerospace Industries, Honeywell, Rafael Advanced Defense Systems, CETC and CASIC are the companies best positioned to benefit from investments in drones, all of them recording scores of five out of five in GlobalData’s Defense Thematic Scorecard.

Boeing, for example, has advertised for 603 new drones jobs from January 2021 to December 2021, has completed one deal related to drones with other companies and mentioned drones in company filings five times.

Northrop Grumman indicated good levels of AI investment, with the company looking for 122 new drones jobs since January 2021 and mentioning drones in filings 27 times.

The table below shows how GlobalData analysts scored the biggest companies in the aerospace and defence industry on their drones performance, as well as the number of new drones jobs, deals, patents and mentions in company reports since January 2021.

The final column in the table represents the overall score given to that company when it comes to their current drones position relative to their peers. A score of five indicates that a company is a dominant player in this space, while companies that score less than three are vulnerable to being left behind. These can be read fairly straightforwardly.

The other datapoints in the table are more nuanced, showcasing recent drones investment across a range of areas over the past year. These metrics give an indication of whether drones is at the top of executives’ minds now, but high numbers in these fields are just as likely to represent desperate attempts to catch-up as they are genuine strength in drones.

For example, a high number of mentions of drones in quarterly company filings could indicate either the company is reaping the rewards of previous investments, or it needs to invest more to catch up with the rest of the industry. Similarly, a high number of deals could indicate that a company is dominating the market, or that it is using mergers and acquisitions to fill in gaps in its offering.

This article is based on GlobalData research figures as of 13 January 2022. For more up-to-date figures, check the GlobalData website.