China’s assertiveness in the South China Sea and Indo-Pacific region has raised tensions with Australia, provoking Australian defence spending increases.

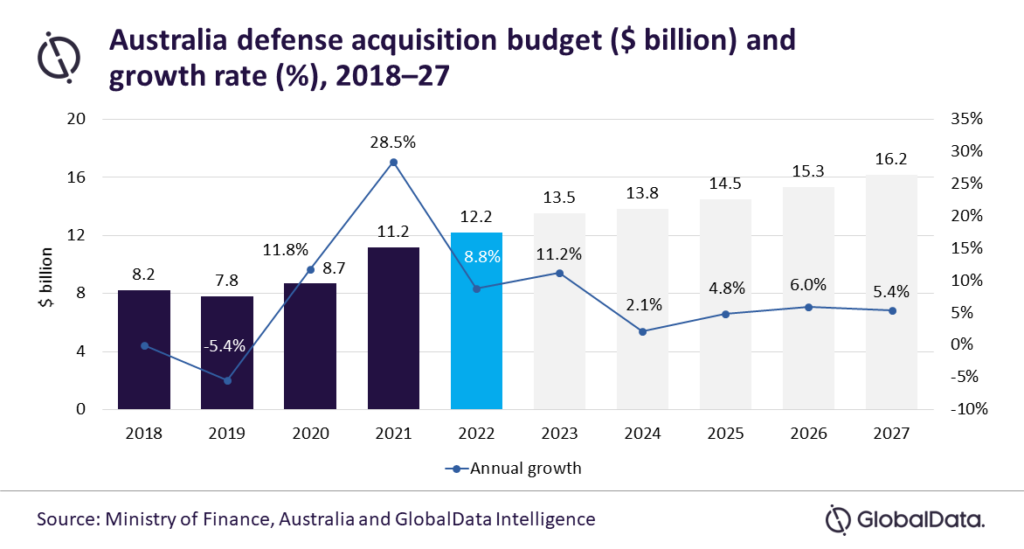

Australia will raise its defence budget annually by an average of 3.8% for the next five years, according to GlobalData, with the increase intended to achieve program modernisations and to maintain security and stability in the surrounding Indo-Pacific region and South China Sea.

Australia defence spending to grow at 3.8% CAGR between 2022-2027

Between 2018 and 2022, Australian spending on defence acquisition and research and design increased from $8.2bn to $12.2bn, recording a compound annual growth rate (CAGR) of 10.3%. GlobalData’s latest report, ‘Australia Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-27’, notes that the increase is largely attributed to a slew of defence procurements and R&D investments in naval vessels and submarine sectors.

Australia is procuring Hunter-class frigates and Arafura-class patrol vessels to replace ageing Anzac-class frigates and the Armidale and Cape-class patrol boats. It also plans to procure nuclear-powered submarines to modernise its naval capabilities and replace the ageing fleet.

“Rapid military modernisation and technological developments in countries such as Russia, China, and North Korea are expected to create strategic challenges for Australia,” said Akash Pratim Debbarma, GlobalData Aerospace & Defense analyst. “Being an island nation, modernisation of its naval prowess is a necessity for Australia.”

China’s artificial islands

The South China Sea is one of the most important global shipping lane for Australian iron ore, LNG, and coal exports. Australia considers China’s construction of artificial islands there to be one of its most pressing security threats and the desire to keep trade routes open has escalated tensions between the two countries.

“With Chinese military assertiveness over the South China Sea and Indo-Pacific region, Hunter-class frigates will prove to be an asset,” added Debbarma. “Future procurement of nuclear-powered submarines is surely a strategic move needed to replace their Collin-class diesel-electric submarines.

“However, for Australia, increasing its defence budget… also improves its domestic defence industry and positions itself as a leader in global exports. The desire to increase its acquisition budget will not only result in securing its borders but will also create opportunities for the naval shipbuilding industry,” Debbarma said.

Ambitious modernisation programmes

Elsewhere in the Asia-Pacific region, the Singapore Armed Forces (SAF) are engaged with an ambitious defence programme. It will drive Singapore’s defence expenditure to $15.8bn in 2027, modernising military equipment, homeland security, and cyber security.

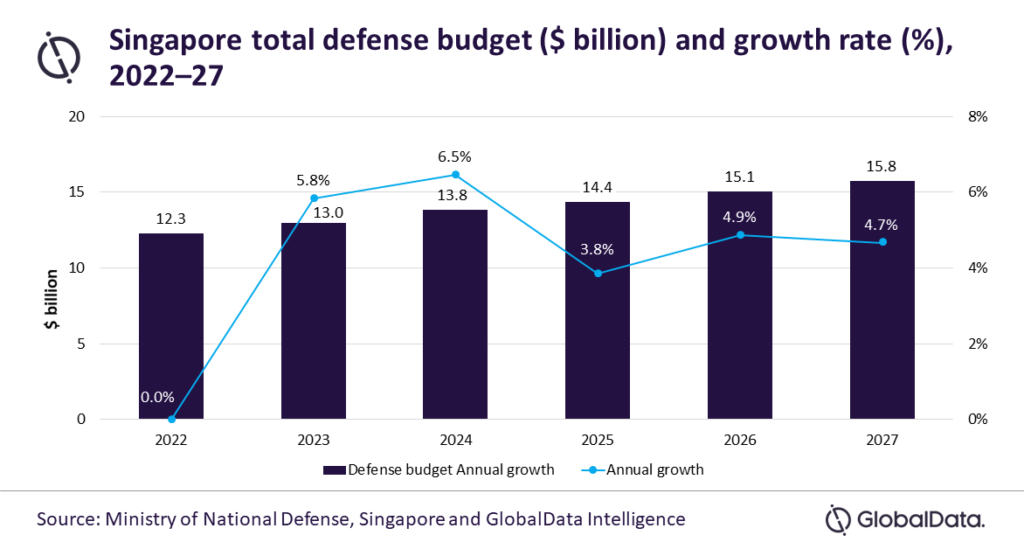

According to GlobalData’s report, ‘Singapore Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-27’, Singapore has allocated a defence budget of $12.3bn for 2022, an increase of 7.4% over the allocation in 2021; and reflects a CAGR of 3.7% during 2018-2022.

GlobalData forecasts a defence budget CAGR increase of 5% from $13bn in 2023 to $15.8bn in 2027. This will overcome challenges posed by the country’s small armed forces, and limited training area, with effective personnel training overseas.

Singapore is acquiring advanced military technologies and platforms. These include the F-35 Joint Strike Fighter, CH-47F Chinook and H225M helicopter, and Invincible-class (Type 218SG) submarines. The country is also procuring infantry technology to improve army security and mobility. SAF’s upgrades enhance the force posture of the country’s defence forces and provide an asymmetric advantage.

In line with the ‘SAF 2040’ next-generation initiative, Singapore aims to develop a modernised military to maximise its capabilities.

Singapore’s force posture

Singapore plans to expand its capabilities with the creation of a Digital and Intelligence Service to add to its traditional services. The government has also allocated a substantial amount of expenditure towards the procurement of advanced unmanned aerial vehicles. This includes the Orbiter 4, which operates with minimal manpower, overcoming the limitations of Singapore’s small population.

Upgrading command, control, communication, and intelligence systems will further increase the country’s regional coordination, and continued government efforts to use technology as a force multiplier will increase the country’s overall defence expenditure.