Lockheed Martin has exceeded analyst expectations, but uncertainty over the future Saudi- US defence relations could impact the company’s future.

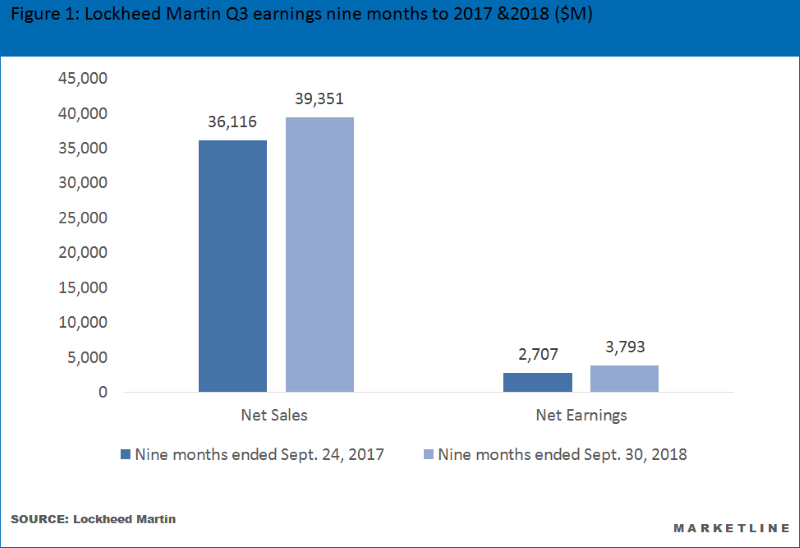

The company announced better-than-expected financials for Q3 2018 with net earnings increasing 51.4% over the same quarter in 2017, totaling $1,473m and $973m respectively. This has led the company to increase its estimates for full year 2018 results and now expects 2018 net sales of $53bn, which is above the average market analyst estimate of $52.6bn, according to Reuters.

However, there has been discontent in Washington regarding Saudi Arabia’s alleged killing of journalist Jamal Khashoggi and it is plausible that weapons contracts with the country could be under threat. Lockheed Martin’s largest outstanding contract at present is with Saudi Arabia to supply THAAD air defence systems and is worth $15bn to the company.

While Trump was initially reluctant to sanction Saudi Arabia, citing job concerns for US weapons manufacturers, the administration has since adopted a more aggressive tone.

In 2017, Lockheed Martin pursued and secured new, strategic opportunities in the Kingdom of Saudi Arabia. Agreements between the US government and Saudi Arabia opened up the potential for the sale of $28bn of Lockheed Martin technologies over the next decade.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataInternational business is increasingly significant to the company, accounting for 30% of Lockheed Martin’s total sales in 2017, compared to 17% in 2011. International expansion, particularly with US geopolitical allies, is a cornerstone of the company’s growth strategy.

Lockheed itself remains buoyant about the situation, stating it does not feel that the loss of this contract will hurt its financial forecasts for the coming years. However, since the company failed to win three major defense contracts that concluded in Q3 2018, the company does have cause for concern should this supply be postponed or cancelled.

The US defence market has led to increases since Trump assumed office, reversing years of sequestration since 2011. The FY2019 federal defense budget is up 3% over FY2018, and 2018 was up over 9% over FY2017.

Despite controversy around the company’s F-35 program, not least the grounding of half the world fleet due to technological problems at the beginning of 2018, sales have been improving. The company secured a contract with the Department of Defense for the production and delivery of an additional 141 F-35 aircraft.

The company also reduced its tax burden due to higher pension payments of $1.5bn. Lockheed’s tax rate therefore fell to 6.5% in Q3 2018. The company benefitted from lower US corporate taxes; by comparison in Q3 2017, Lockheed had a rate of 25.8%.

Related Company Profiles

Lockheed Martin Corp