Teledyne Technologies Incorporated has signed a definitive agreement to acquire FLIR Systems in a cash and stock transaction valued at nearly $8bn.

As agreed, FLIR stockholders will receive $28 per share in cash and 0.0718 shares of Teledyne common stock for each share.

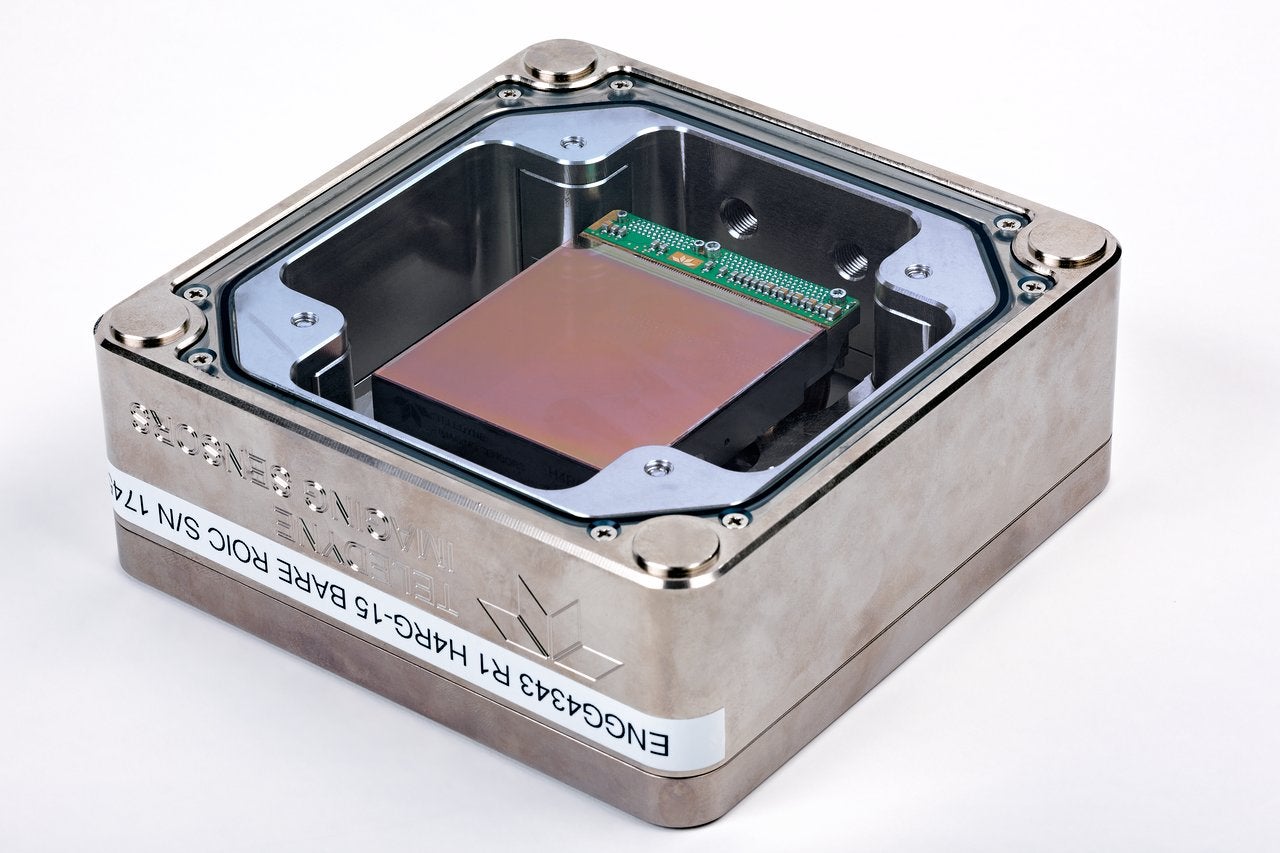

Established in 1978, FLIR focuses on delivering intelligent sensing solutions defence and industrial applications. Its product portfolio includes unmanned systems, thermal imaging cameras, surveillance and monitoring systems among others.

With this acquisition, Teledyne, which also manufactures digital imaging products and software, seeks to complement its portfolio and deliver better returns to the stockholders.

The deal is also expected to be immediately accretive to earnings, excluding transaction costs and intangible asset amortization, and accretive to GAAP earnings in the first full calendar year following the completion of the deal.

Teledyne executive chairman Robert Mehrabian said: “At the core of both our companies is proprietary sensor technologies. Our business models are also similar: we each provide sensors, cameras and sensor systems to our customers.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“However, our technologies and products are uniquely complementary with minimal overlap, having imaging sensors based on different semiconductor technologies for different wavelengths.

“For two decades, Teledyne has demonstrated its ability to compound earnings and cash flow consistently and predictably. Together with FLIR and an optimised capital structure, I am confident we shall continue delivering superior returns to our stockholders.”

FLIR president and CEO Jim Cannon said: “Together, we will offer a uniquely complementary end-to-end portfolio of sensory technologies for all key domains and applications across a well-balanced, global customer base.”

The transaction is expected to close in the middle of this year, subject to the necessary regulatory and shareholders approvals as well as other conditions.

In November, FLIR Systems secured a contract to deliver 250 Centaur unmanned ground vehicles (UGV) to the US armed forces.