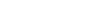

The global military uncrewed ground vehicle (UGV) market is projected to glow at a compound annual growth rate of 5.9% over the next decade, from $668m at present to nearly $1.2bn by 2034, according to GlobalData’s latest analysis of the sector.

Combined from 2024-2034, the global UGV market will cumulatively value $9.7bn over the forecast period and will be dominated by the combat UGV segment, which accounts for 33.7% of the market, followed by the intelligence, surveillance and reconnaissance (ISR) UGV segment with a 26.7% share.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Among geographic segments, North America is projected to dominate the sector with a share of 41.6%, followed by Asia-Pacific and Europe with shares of 32.1% and 22.1%, respectively, GlobalData states.

The market consists of four categories: intelligence, surveillance, and reconnaissance (ISR) UGVs, logistics UGV, explosives and mine disposal (EOD) UGV, and combat UGV segment.

Militaries have been utilising UGVs for decades due to benefits such as increased autonomy, endurance, and attritabilty, as well as other areas such as reduced costs and increased distribution.

Combat UGVs lead military UGV market as trials determine battlefield potential

The growth of the combat UGV segment aligns with the growing comfort in militaries looking to harness autonomous systems at the tactical level in order to exert a strategic advantage on the battlefield, in much the same way as small uncrewed aerial systems have been adapted for combat roles in wars in Ukraine and the Nagorno-Karabakh.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAmong the most prominent combat UGVs under development recently are the Themis and Type-X platforms developed by Estonian defence company Milrem Robotics. In February 2023 UAE state-owned conglomerate EDGE Group agreed to purchase a majority controlling share in Milrem Robotics.

Israel is also pursuing the development of combat UGVs through programmes such as the ROBUST M-RCV, designed by Elbit Systems. ROBUST was one of the three platforms selected to participate in a March 2023 trial organised by the UK Defence Equipment & Support’s Future Capability Group to demonstrate the effectiveness of UGVs in battlefield situations, along with the Milrem’s Themis and another solution provided by German OEM Rheinmetall.

Meanwhile, the US Army’s Robotic Combat Vehicle (RCV) programme will deliver three RCV variants: light, medium, and heavy. In March 2023, the US Army requested RCV prototype proposals, detailing a three-phased effort that would select up to four vendors to deliver test vehicles by August 2024.

The US Army envisions employing RCVs as scouts and escorts for crewed fighting vehicles, operating ahead of or protecting the flanks of larger formations.

In May 2023 Oshkosh Defense submitted a design proposal for the US Army’s RCV programme.